Material uncertainties that cast significant doubt on the company’s ability to operate under the going concern basis need to be disclosed in the financial statements. The assessment relates to at least the first twelve months after the balance sheet date, or after the date the financial statements will be signed, but the timeframe might need to be extended. The going concern assessment needs to be performed up to the date on which the financial statements are issued. IAS 1 Presentation of Financial Statements requires management to assess a company’s ability to continue as a going concern. How Should Companies Assess Going Concern? Examples of non-adjusting events that would generally be disclosed in the financial statements include breaches of loan covenants, management plans to discontinue an operation or implement a major restructuring, significant declines in the fair value of investments held and abnormally large changes in asset prices, after the reporting period. If it cannot be reliably quantitively estimated, there still needs to be a qualitative disclosure, including a statement that it is not possible to estimate the effect. If management concludes the impact of non-adjusting events are material, the company is required to disclose the nature of the event and an estimate of its financial effect. February or March 2020 year ends), it is likely to be a current-period event which will require ongoing evaluation to determine the extent to which developments after the reporting date should be recognized in the reporting period. With respect to reporting periods ending on or before 31 December 2019, there is a general consensus that the effects of the COVID-19 outbreak are the result of events that arose after the reporting date (e.g., in the UK, the Financial Reporting Council has stated that COVID-19 in 2020 was a non-adjusting event for the vast majority of UK companies preparing financial statements for periods ended 31 December 2019).

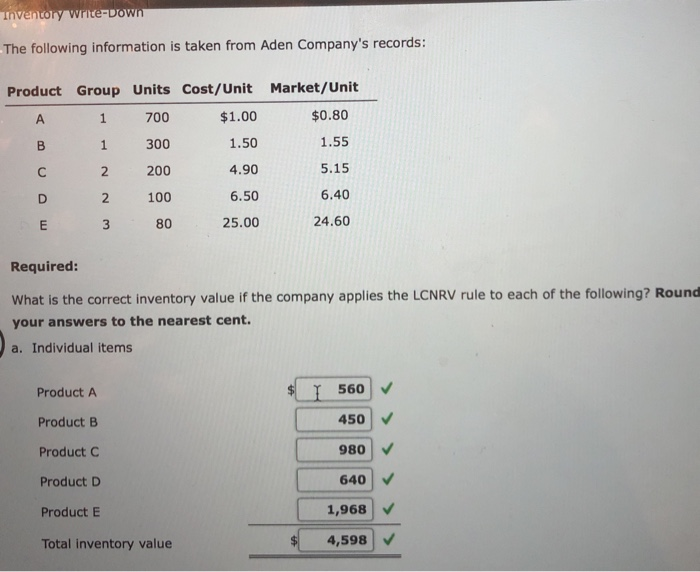

#INVENTORY WRITEDOWN SUPPLIER RESTRICTIONS UPDATE#

Management may need to continually review and update the assessments up to the date the financial statements are issued given the fluid nature of the crisis and the uncertainties involved. This will be highly dependent on the reporting date and the specific facts and circumstances of each company’s operations and value chain. Judgment is required in determining whether events that took place after the end of the reporting period are adjusting or non-adjusting events.

Amounts recognized in the financial statements are adjusted to reflect adjusting events, but only disclosures are required for material non-adjusting events. IAS 10 Events after the Reporting Period contains requirements for when adjusting events (those that provide evidence of conditions that existed at the end of the reporting period) and non-adjusting events (those that are indicative of conditions that arose after the reporting period) need to be reflected in the financial statements. How Should Companies Assess COVID-19 Events After the Reporting Period? There may also be differences in approach depending on whether financial statements are prepared using IFRS or national GAAP. However, information must be reliable and all material financial information relevant to an understanding of the financial position or performance of the company should be appropriately disclosed. Some companies may first report financial effects in interim financial statements (in accordance with IAS 34 – Interim Financial Reporting), which will likely involve the greater use of accounting estimates. There will be issues to consider for this year’s reporting as well as in future years. To help consolidate the highlights of this guidance, a summary of key areas to consider is outlined below together with links to key references on the IFAC website. Many of these resources are conveniently available through IFAC’s COVID-19 resource center. To this end, accountancy firms, regulators, IFAC member organizations and others have quickly made available advice and guidance on the accounting and financial reporting requirements that will need to be considered in addressing the financial effects of COVID-19 when preparing financial statements.

The COVID-19 pandemic crisis and its economic effects mean that investors and other stakeholders need high-quality financial information more than ever.

0 kommentar(er)

0 kommentar(er)